Global transfer spend surpasses pre-pandemic levels for the first time after Saudi Pro League's huge jump in spending leads to increased transfer fees elsewhere.

The emergence of the Saudi Premier League made 2023 the biggest summer window of all time, as our report on summer transfer business up until 1 September shows.

Big Saudi Pro League spend leads to record window

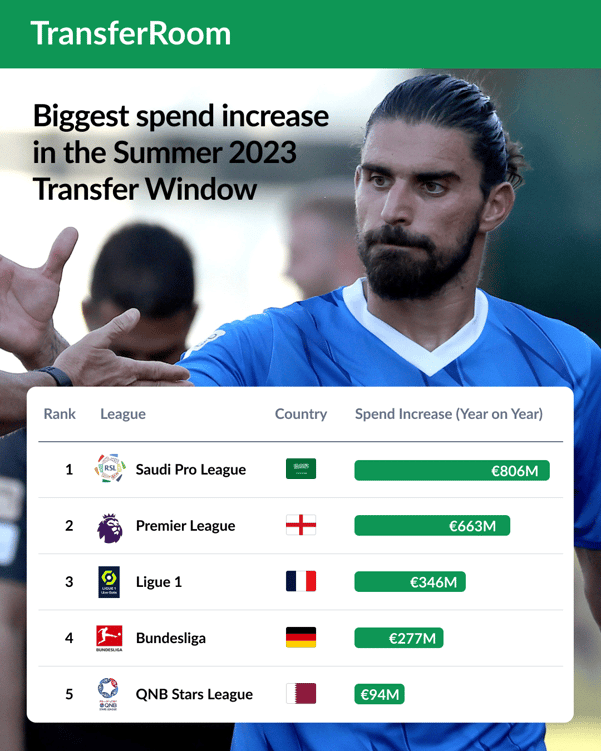

A number of leagues set records for transfer outlay in the 2023 Summer Transfer Window but it was the Saudi league that dominated the narrative and played a huge part in spending exceeding pre-pandemic levels for the first time.

The emergence of the Saudi Premier League made 2023 the biggest summer window of all time, as our report on summer transfer business shows. Our report covers the period up to 1 September, the deadline for the big five European leagues.

The total global spend of €8.33billion was 32 per cent up on the same period in 2022 and set a new record by exceeding the pre-pandemic high of €7.5bn set in 2019.

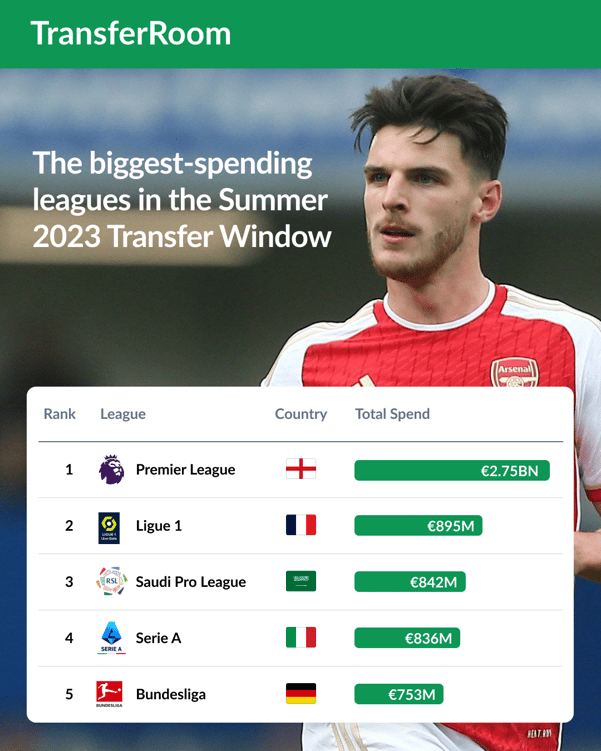

Clubs in the English Premier League and France’s Ligue 1 spent more than they had ever done before.

But it was the dramatic increase in transfer activity by the Saudi Pro League that made the real difference by injecting fresh cash into the market and pushing prices up across the board.

Al-Nassr FC’s signing of Cristiano Ronaldo in the January 2023 window was followed up in astonishing style.

Al-Nassr and the three other clubs backed by Saudi Arabia’s Public Investment Fund led spending that was unprecedented in one window for a competition outside the big five leagues.

The total expenditure of €842m represented a €806m increase, a percentage jump of 2285% from 2022’s €36m, making the Saudi Pro League the third highest-spending league in the world. This record was fuelled by the €90m Al-Hilal paid for Neymar and other big-money deals such as Malcolm for €60m and Rúben Neves (pictured) for €55m to the same club.

The Saudi league's major spending also led to the competition rising 38th to 17th in our global rankings of leagues by Average Player Rating in the Summer Transfer Window alone, after the biggest increase in player quality of any league in that time.

But the English Premier League remained far and away the market leader.

The total spend of €2.75billion represented almost a third of the global total and was more than three times Ligue 1’s €895million, the second-highest figure.

Of the total EPL spending, €837m was between its own clubs - more than the €836m that Serie A clubs spent to put the Italian league fourth in the table.

Declan Rice’s move from West Ham United to Arsenal, and then Moises Caicedo’s transfer from Brighton & Hove Albion to Chelsea, set new domestic records at well over €100m for each deal.

The Premier League’s increase in spending from 2022 - 32 per cent - was less than other big five European leagues.

Ligue 1’s spend increased by 63% and the Bundesliga’s €753m was up 58% on 2022.

The top flight in the Netherlands, the Eredivisie, spent 37% more than last summer.

But the phenomenon was not confined to Europe.

In the Americas, the Argentinian Primera División increased spending by 97%, Mexico’s Liga MX saw growth of 69% and Major League Soccer in the United States had an increase of 58%. Both Liga MX and MLS have league-wide agreements with TransferRoom, helping to drive the domestic and international transfer market in those regions.

While the Saudi Pro League provided a lot of the extra cash circulating in the system, Qatar’s QNB Stars League also increased its spending massively - the extra £94m representing a rise of 1076%.

The money from clubs in the Middle East was a big factor in the Bundesliga, Serie A and Eredivisie all making a transfer profit. Even the English Premier League, despite its huge outlay, was able to decrease its net spend overall.

There were exceptions to the boom in transfer spending.

The most significant drop in expenditure was for La Liga, where FC Barcelona’s decrease in transfer activity compared to the previous year was the main reason for a 17% fall to €420m - barely half as much as the Saudi Pro League.

Barcelona and Spanish top-flight clubs weren’t the only ones cutting spending.

There was a trend across second-tier competitions, in Europe in particular, for significant falls in investment in new players.

The biggest fall of 66% was in Italy’s Serie B, closely followed by Spain’s La Liga 2 (58%) and Germany’s 2.Bundesliga (55%).

English second tier generates biggest profit

England’s Championship clubs made a huge profit on transfers of €262m, up from €72m the year before. That was partly due to a fall in spending of €87m (32%) but also reflected the effective selling policies of the three relegated clubs.

Southampton negotiated fees of around €180m as they moved on a number of their players and recorded a net profit of €160m, the highest profit in the world this summer. That included their big-money sales of Romeo Lavia to Chelsea, Tino Livramento to Newcastle United and James Ward-Prowse to West Ham United. TransferRoom also played a part in Southampton selling Moussa Djenepo and the incoming loans of Ryan Fraser and Taylor Harwood-Bellis.

But overall, the theme of the summer was the Saudi Pro League driving the biggest spending spree football has ever seen.

That is despite 81 per cent of the 28,787 deals being free transfers - a fact often overlooked when all the headlines are being taken by big-money moves.

Nonetheless the average cost in the 1,467 deals with a transfer fee increased by 39% to €5.7m, reflecting the overall inflation in the market caused mainly by the SPL’s intervention. Further evidence of a new era in football picking up pace.

Club decision makers, maximise your opportunities to recruit smartly, drive interest in your players and see the real-time transfer requirements of over 700 clubs worldwide by joining TransferRoom. Find out more here.

Related content

Where does the Saudi Pro League rank in world football? Player Ratings revealed

Book an intro call

Trusted by decision makers from 800+ clubs worldwide

/SWEDEN/Malm%C3%B6%20FF.png)